Newsletters

Our regularly updated newsletter provides timely articles to help you achieve your financial goals.

The IRS recently announced the suspension of more than a dozen automated collection taxpayer notices, including collection notices, balance due notices, and unfiled tax return notices.

The IRS recently announced the suspension of more than a dozen automated collection taxpayer notices, including collection notices, balance due notices, and unfiled tax return notices.

The change comes after calls from lawmakers and tax professionals for the agency to catch up on its unprocessed backlog of several million original and amended returns filed by individuals and businesses.

“IRS employees are committed to doing everything possible with our limited resources to help people during this period,” IRS Commissioner Chuck Rettig said in a Feb. 9 statement. “We are working hard, long hours pushing creative paths forward in an effort to be part of the solution, rather than the problem. Our employees continue to expend every effort to balance a confluence of multiple, unprecedented demands — including successfully starting the filing season, working our inventory of unprocessed tax returns as well as looking for additional ways to minimize the burden for taxpayers, tax professionals, and businesses. Our efforts are not limited to the suspension of these additional letters and the possibility of similar actions going forward. We have redeployed and reallocated resources throughout the IRS and have implemented innovative strategies in an ongoing effort to provide a meaningful reduction in our inventories.”

These automatic notices have been temporarily halted until the backlog is worked through. The IRS will continue to assess the inventory of prior year returns to determine the appropriate timeframe for reinstating the notices.

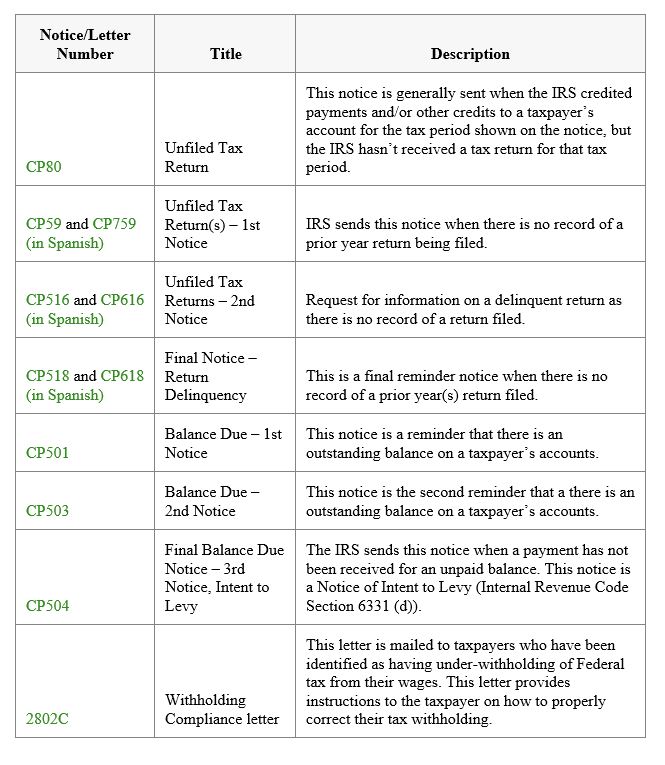

The suspended notices include:

For more information please feel free to contact us at info@millermusmar.com or call us at 703-437-8877.

MillerMusmar CPAs is an established accounting firm with offices in Reston, Virginia. We have a twenty-five-year history of providing top-quality auditing, tax, and accounting services to clients throughout the Washington Metropolitan area and internationally. By combining the expertise of a mid-sized firm with personal attention, we are both large and small enough to deliver a responsive service to our clients. For more information, please visit our website at www.MillerMusmar.com.