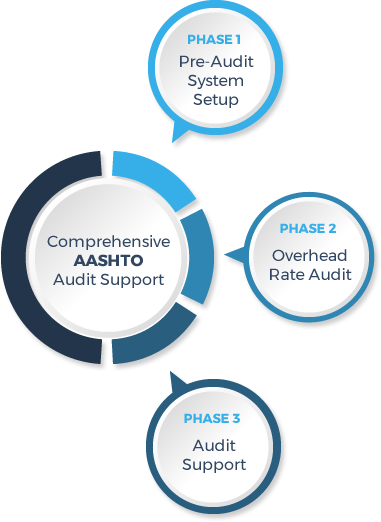

Pre-Audit System Setup includes ensuring your accounting system includes: a proper Chart of Accounts with segregated cost pools; a compliant and integrated timekeeping system; appropriate internal controls; accurate mapping of direct and indirect labor and nonlabor costs; cost allocation methodology and procedures; and tracking of unallowable costs.

Pre-Audit System Setup includes ensuring your accounting system includes: a proper Chart of Accounts with segregated cost pools; a compliant and integrated timekeeping system; appropriate internal controls; accurate mapping of direct and indirect labor and nonlabor costs; cost allocation methodology and procedures; and tracking of unallowable costs.

Performing an Overhead Rate Audit includes the calculation of precise overhead rates to be submitted to your local Department of Transportation. Our Overhead Rate Audit demonstrates that adequate documentation supports the calculated overhead rate, and prepares you for responses to agency inquiries. We ensure your system is compliant with applicable CAS and FAR standards along the way.

Your state DOT will likely audit your overhead rate submission. Our team has experience representing clients in DOT audits across several states. Don’t enter these agency audits alone – put our advocacy skills on your side to defend your overhead rate position with the state DOT auditors.